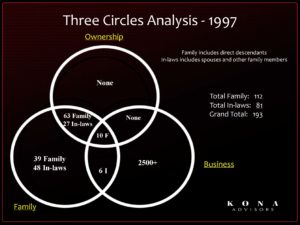

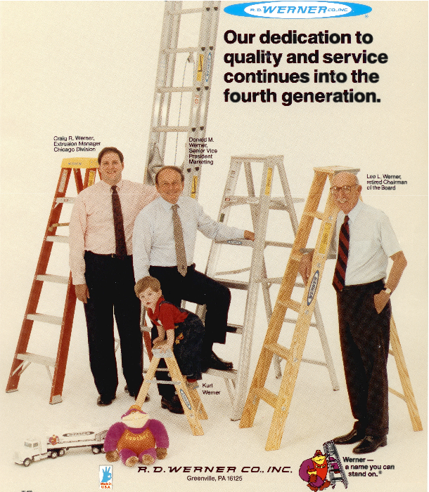

In this episode, Ellie Frey Zagel speaks with Bruce Werner, who is a member of the third generation of Werner Co., a ladder and climbing equipment company that was sold in the late 90s. At the time of the sale, Bruce was one of 10 second and third-generation family board members. Today, Bruce is the Managing Director of Kona Advisors, where he provides strategic advisory services to owners and investors of private companies.

In this conversation, Bruce shares his family business story that began with generation one immigrating to the U.S. in the 1880s. There were 12 children in the family, and from very humble beginnings, one son set out to do whatever he could to survive. He sold coffee pots following World War I, and shifted to flower pots and then flooring before finding success in manufacturing and selling aluminum ladders. He pulled his brothers into the business, which they passed on to a second and third generation. The company sold in 1997 for $400 million. In that time, the family had grown to nearly 200 members strong.

Bruce talks about his experience joining the family business and the governance they adopted to navigate the varying needs and wants of different branches of the family. He says, “We practiced good governance, not because it made us money, but simply because it was the right thing to do.” Three key things his family did to manage the business while keeping family first, included:

- Creating a family constitution, which was a comprehensive rule book that covered acceptable behaviors, compensation, stock, leaving the business, rights and privileges of spouses, etc.

- Developing three rules for entering the business: 1. You had to work somewhere else first. 2. You started at the bottom and worked your way up. 3. You worked for your uncle, not your father.

- Holding family assemblies (or annual family meetings) that included education for the whole family, strategic planning for board members, and quality time together for relationship building.

In the interview, Bruce and Ellie also talk about the role of the board in the business. In the 50s and 60s, Werner had outside directors on the board. From the 80s until the time of the sale, it was only family on the board—something Bruce believes was a mistake. “A business of any size or complexity needs independent outside directors,” Bruce says.

The discussion includes the process for selecting and training boards members. Bruces recommends starting with a board charter that states what the board will do and how success will be determined. It is important to consider what issues the business will face in the coming years and what areas need outside expertise. From there, a matrix can be created, mapping out current board members and identifying any gaps. A position description can then be created, followed by a traditional recruiting process.

In terms of selecting board members, Bruce says that chemistry is important. Bruce relies on the airplane test: “If you wouldn’t fly across the country sitting next to the person, why would you want them on your board?”

Ellie and Bruce conclude discussing board member compensation.

In this episode:

- Meet Bruce Werner (1:25)

- An overview of the Werner family (5:10)

- Werner family governance (10:20)

- Planning to sell the family business (22:10)

- Life after the sale (32:40)

- The business of the board (38:30)

- How to recruit quality board members (41:30)

- Board compensation (44:20)

- Bruce’s advice for families (49:56)

- Where to find Bruce (53:40)

Resources from this episode:

Insights and Lessons for Surviving the Sale of a Family Business

Game Plan for Using Outside Directors in Family Business

Notable and Quotable:

The business is an asset, not a child. —Bruce Werner

Because we put family first, the thing that made us successful in the past wasn’t what the future was about. —Bruce Werner

Good consultants are like shoes. The prettiest one might not fit well. Find one that fits really well. —Bruce Werner

In a family business, it’s the conversation that matters not the vote. —Bruce Werner

Guest Bio:

Bruce Werner is the Managing Director of Kona Advisors LLC, which provides advisory services to owners and investors of private and family-owned companies. With exceptional experience in finance, strategy, M&A, governance, and succession planning, Kona Advisors creates practical solutions to the most challenging corporate problems.

Mr. Werner is an experienced Corporate Director, leading businesses through periods of positive transitions as well as crises. He writes and speaks on governance issues of concern to private and family businesses.

In addition to his advisory work, Bruce has acted as a principal or consultant to several investment firms, with experience in running venture, private equity, hedge and real estate funds, as well as futures & options firms.

Mr. Werner spent 12 years at Werner Holding Co. in a variety of senior line and staff positions. He held executive responsibilities in the Climbing Products, Aluminum Extrusion and Insurance businesses. During his tenure the company grew from $180M to over $500M in revenues.

Prior to Werner Holding Co., he co-founded a technology company that developed proprietary products for the engineering workstation market. Early in his career he worked as an engineer for a Kleiner Perkins venture company.

Mr. Werner earned a B.S. degree in Mechanical Engineering and Engineering and Public Policy with honors from Carnegie-Mellon University. Having earned an IBM Fellowship, he graduated from Stanford University with a M.S. degree in Manufacturing Systems Engineering. Mr. Werner completed his M.S. Management degree at the MIT Sloan School.

Learn more at konaadvisors.com.

Subscribe to the Successful Generations Podcast

Don’t risk missing out on any of the fun that is to come.

Want more of Successful Generations?

Want more Successful Generations podcast episodes on the topic of family business? Get them here.

Learn more about Successful Generations:

FB: @SuccessfulGenerations

Twitter: @EllieFreyZagel

Email: ellie@successfulgenerations.com

Instagram: SuccessfulGenerations

Have a topic suggestion?

If you are the next generation of family business, philanthropy and wealth, and have a topic you think we should discuss, let us know at Ellie@successfulgenerations.com.